GET A FREE CONSULTATION TODAY!

Fill in the details, and our experts will contact you.

The Goods and Services Tax (GST) is a tax added to most products and services bought in Canada. Complying with the GST rules is not only an obligation for small businesses, but it also helps them financially. Since the Canada Revenue Agency (CRA) is focusing on GST compliance in 2025, you must make sure your GST records are updated and correct all the time.

This guide is meant to assist Canadian businesses in discovering why they should reconcile their GST and how to do it right. If you are in small business operations, finance sectors or manage an outsourced accounting firm, this guide gives the basic recommendations for GST reconciliation beginning in 2025.

GST reconciliation ensures your bookkeeping records match the data in your GST returns. It makes certain that your company’s accounts and reports match the official figures given to the tax authorities.

|

In simple words, reconciliation ensures that:

|

If financial records are reconciled regularly, companies are less likely to face audits, pay penalties or get charged interest. It forms part of your standard ways to supervise and manage accounting records within your business.

When the GST return information is not accurate or not uniform, the CRA may conduct an audit. If there are any errors, your business can be charged with penalties, late fees or added interest. Using reconciliation allows you to detect and repair any errors before your returns are sent to the IRS

Only business expenses where GST is paid are eligible for ITCs. You ensure you receive all the valid ITCs by reconciling and also avoid any potentially incorrect ITCs that the CRA might pick up.

Regularly reconciling GST helps to improve your financial reporting. It supports the matching of everything on your general ledger, your bank statements and your tax declarations

During audits, the CRA will ensure your reported and actual GST amounts are consistent. Proper reconciliation reports assist the audit process and make it less tense.

When reconciling GST, you should go through and compare key information on your records.

With that, we can move on to performing a successful GST reconciliation for 2025. Whether you handle it yourself or use software, the steps are the same.

_1.webp)

Step 1: Log in to the CRA Portal to obtain your GST Returns.

Go to your CRA My Business Account and get your latest GST/HST returns. You will use these documents as your main reference as you settle your taxes.

If you have an accounting system such as QuickBooks, Xero or Sage, extract GST summary reports, sales tax reports and input tax credit summaries. Ensure the period covered in the invoices matches the period in your GST return.

Review if the GST collected from customers and the amounts included on your return are the same. Cross-check the rates for tax in each invoice and ensure that all taxable products are reflected.

Make sure the payments for GST match the reports from vendors and that the ITCs claimed support the invoices. Remove any expenses that are personal or meant for enjoyment.

If there are inconsistencies in the figures, examine the transactions separately. Review whether any lines are missing, the tax rates are wrong, the same invoice is entered twice, or no record of an adjustment exists.

When all the information is arranged properly, summarize the process and what was discovered in a report. Having the documents on hand may be required if the CRA audits you in the future.

In 2025, businesses can enhance reconciliation while avoiding expensive errors by implementing the following best practices. The use of these tips might improve the overall performance of your writing.

Do not put off the work until the end of the year. When you hire a bookkeeper to make reconciliation at the end of each month or quarter, the chance to detect errors is greater, and your records stay fresh.

Using QuickBooks or Xero in modern times makes GST reconciliation simple. They can handle the tedious job of comparing packs and highlight anything that does not match up properly.

Ensure that the sales and purchases entered by your staff are coded with the proper GST codes. This helps prevent people from being classified incorrectly and pays taxes as they ought to.

Upload your invoices, receipts and contracts to the cloud. These days, CRA audits are often online and having your records handy helps you be ready.

Your finance or admin people should be trained on how to handle ITCs. Practicing each week can yield a more accurate tax filing.

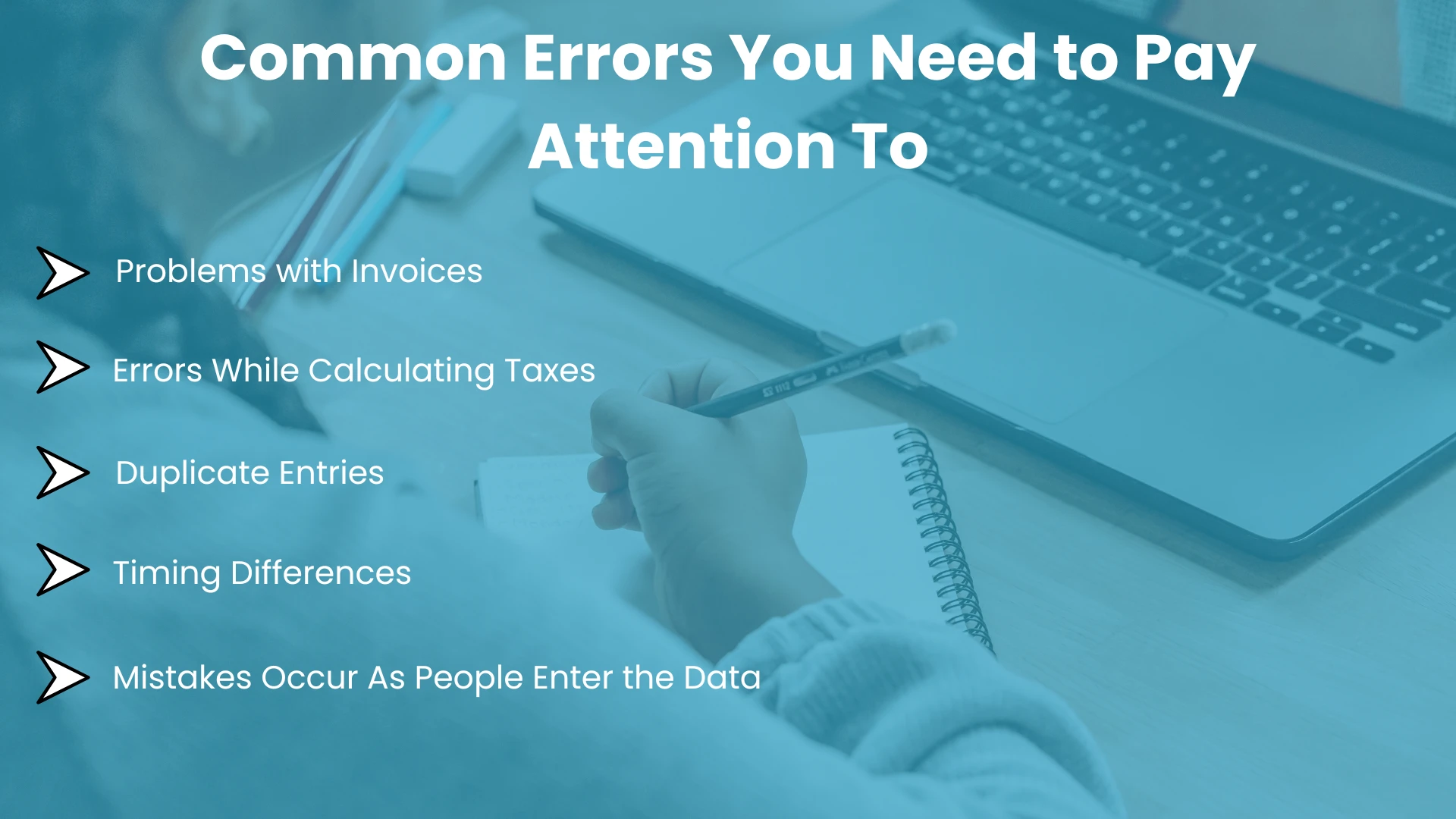

Organized businesses may also face issues during the GST reconciliation process. Noticing the frequent mistakes can allow you to spot problems before they become issues for compliance.

To ensure compliance, avoid mistakes and get the right input tax, reconciliation of GST readings is necessary. In 2025, businesses should remain attentive, reconcile their accounts, use accurate software and keep good records. While the process may be challenging for your business, it allows for clear accounting and prevents major penalties.

In case GST reconciliation is challenging for you, experts can guide you and keep you from spending more time and money. Now, you can rely on Aone Outsourcing.

Aone Outsourcing is known for employing accountants who specialize in meeting Canadian GST/HST requirements. Our team reconciles all your accounts, corrects errors and ensures they are ready for any audits.

Get in touch with us today, so you can strengthen your GST reconciliation and spend less time handling numbers.